The Tactical Difference

Responsive, dynamic portfolio structure and investment process, free of human emotion

Blended portfolio

The Tactical Difference

We Actively Manage Growth Objectives and Risk.

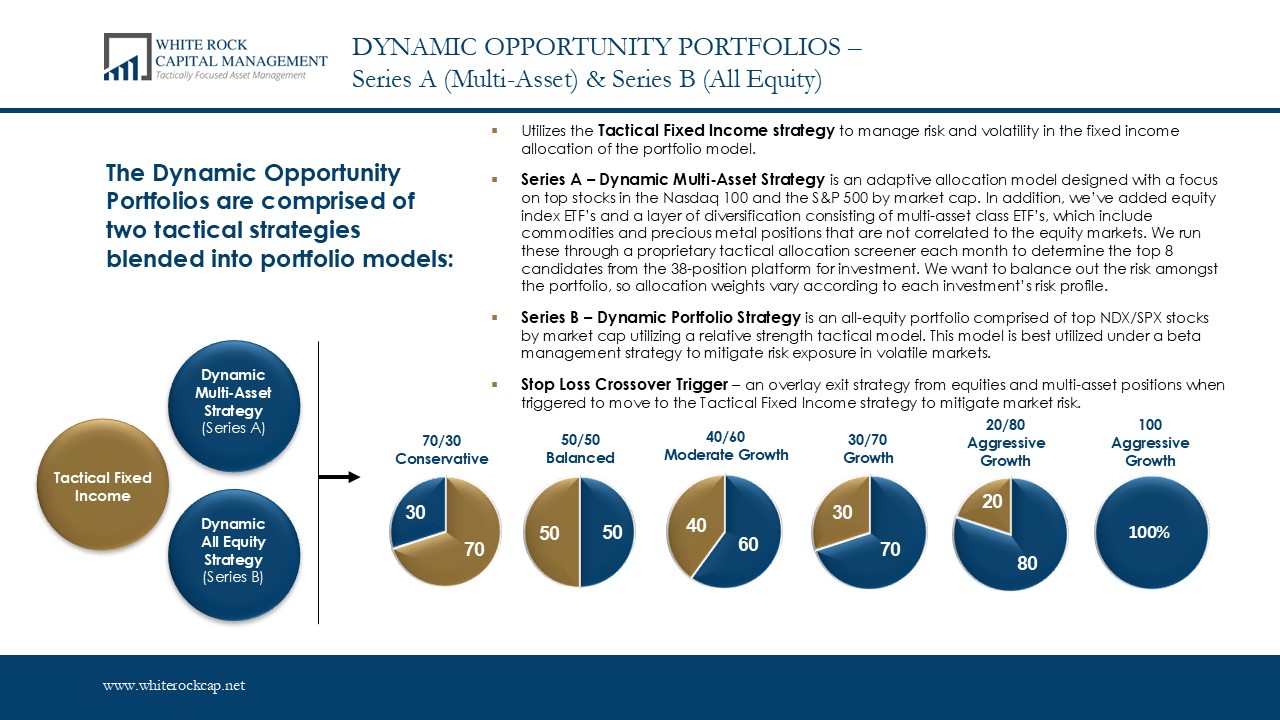

Our Customized Blended Portfolios combine up to three (3) tactical strategies (momentum and risk parity) into one algorithm that respond to markets with the objective of simultaneously maximizing long term growth potential while minimizing risk.

Dynamic Opportunity Multi-Asset Strategy (Series A)

Dynamic Multi-Asset Strategy is an adaptive allocation model designed with a focus on top stocks in the Nasdaq 100 and the S&P 500 by market cap. In addition, we’ve added equity index ETF’s and a layer of diversification consisting of multi-asset class ETF’s, which include commodities and precious metal positions that are not correlated to the equity markets. We run these through a proprietary tactical allocation screener each month to determine the top 8 candidates from the 38-position platform for investment. We want to balance out the risk amongst the portfolio, so allocation weights vary according to each investment’s risk profile.

Dynamic Opportunity All-Equity (Series B)

Dynamic All Equity Strategy is an all-equity portfolio comprised of top NDX/SPX stocks by market cap utilizing a relative strength tactical model. This model is best utilized under a beta management strategy to mitigate risk exposure in volatile markets.

Tactical Fixed Income Allocation

Tactical Fixed Income Allocation: An actively managed fixed income portfolio using tactical asset allocation seeking to increase alpha and reduce volatility by rotating efficiently in and out of asset classes as macro, technical or fundamental trends change

Tailored Strategies to Meet Your Clients Needs

Blended Portfolio Strategies