Tactical Portfolio Strategies Successful Investing is Managing Risk Effectively

Our tactical portfolios are designed to maximize growth in all market cycles and to minimize market risk in poor performing markets. We do that through a tactical management approach.

[/column][column col=”1/2″]

Our core focus is on: [list type=”bullet2″]

- growth

- preservation of capital

[/list]

[/column]

We accomplish the portfolio management goals by:

[column col=”1/2″]

1. Tactical Sector Investing

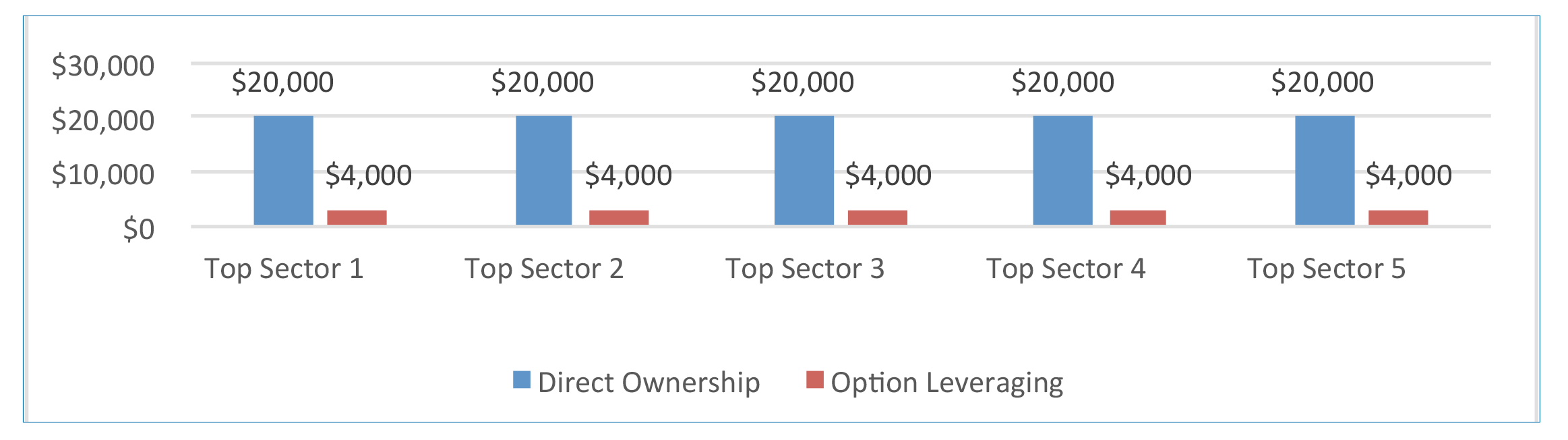

Investing in the top five fastest growing sectors in the market. Make tactical sector changes as necessary to maintain positioning in the fastest growing sectors of the market.

2. Option Leveraging

Mitigate risk by utilizing options to leverage positions so you have little exposure to the market risk but with all the potential gain. [/column][column col=”1/2″]

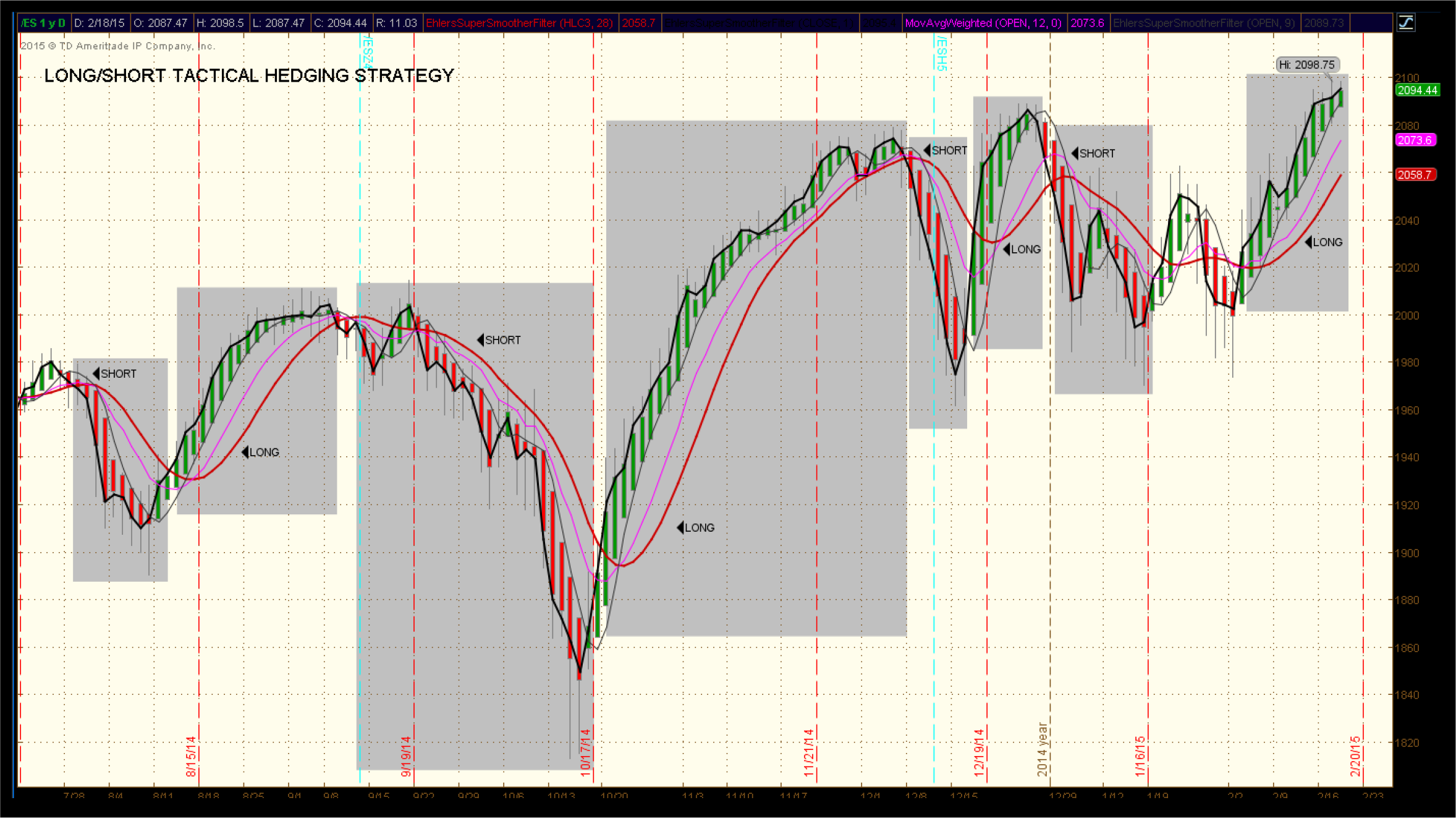

3. Risk Hedging

Utilize hedging strategies that will further reduce risk and in many cases provide returns in a down trending market. [space height=”1″]

4. Reserve Components

Utilize up to 70% of the portfolio in low risk fixed income and cash allocations to mitigate risk exposure to the market. [/column]

[space height=”1″]

Tactical Sector Investing

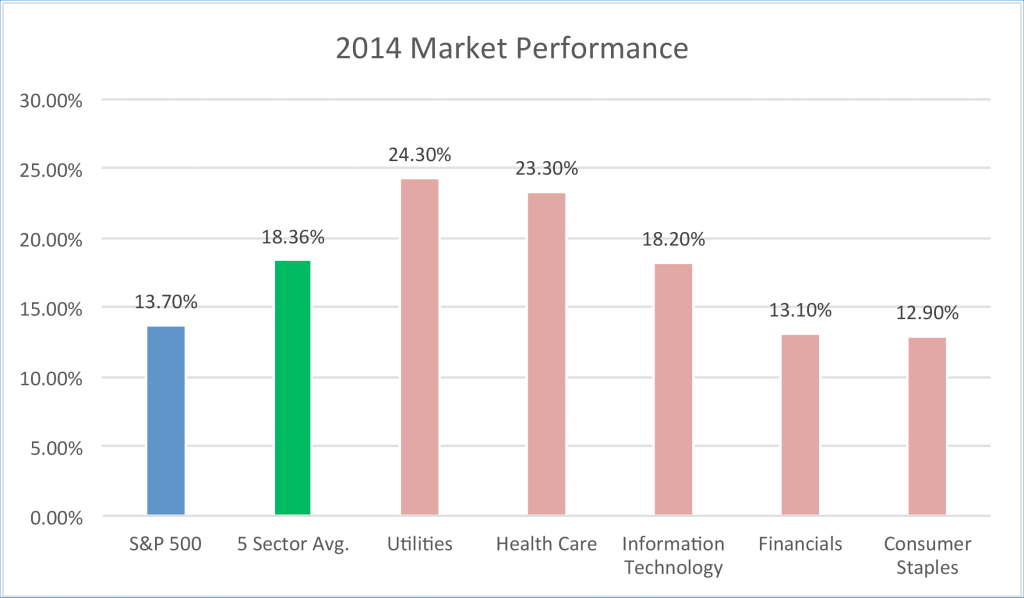

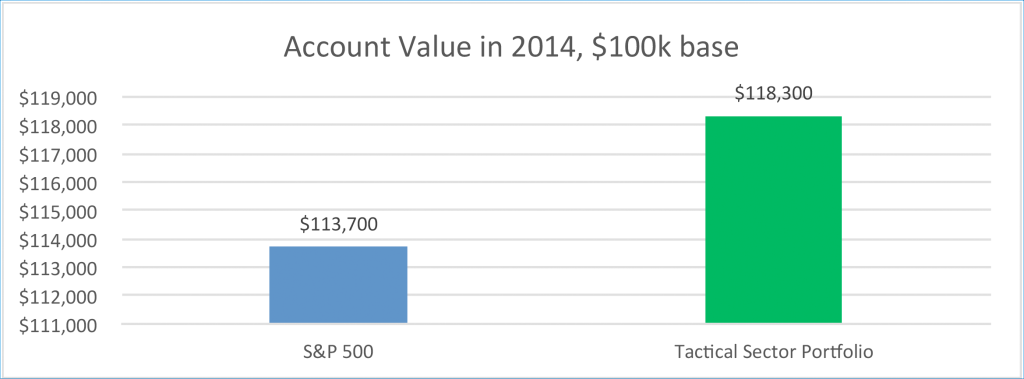

2014 Market Performance

The top five sectors of the market will provide the best performance possible through focusing on only investing in the fastest growing sectors of the market. These charts illustrate what occurred in 2014:

The illustrated returns are the performance of the top five sectors for 2014 comparative to the S&P 500 index. It is not the return of the sector component of the Tactical Strategy Portfolio and does not realize any fees that may apply in the management of the sector positions. This is for illustrative purposes only and is not an indication of the performance of the illustrated sectors in the future. Each year may have a different set of sectors that are the top five performers.

[space height=”1″] [space height=”1″]

[space height=”1″] [space height=”1″]

Options to Mitigate Risk

How We Use Options To Your Advantage

Many people mistakenly believe that options are always riskier investments than stocks. This stems from the fact that most investors do not fully understand the concept of leverage. However, if used properly, options can have less risk than an equivalent position in a stock. [space height=”1″]

What Is Leverage?

[column col=”1/2″]

Leverage has two basic definitions applicable to option trading. The first defines leverage as the use of the same amount of money to capture a larger position. This is usually the definition that gets investors into trouble. A dollar amount invested in a stock and the same dollar amount invested in an option do not equate to the same risk.

The second definition characterizes leverage as maintaining the same sized position in a security, but spending less money to do so. This is the definition of leverage that we apply. Here’s how it works: If you were going to invest $10,000 in a $50 stock, you would receive 200 shares. However, instead of purchasing the 200 shares, you could also buy two call option contracts. By purchasing the options, you spend less money but still control the same number of shares. [/column][column col=”1/2″]

The number of options you purchase is determined by the number of shares that could have been bought with your investment capital, in this case $10,000.

For example, say that the options cost $2.00 per contract. To control 200 shares of the stock, you would need to purchase two contacts at a total cost of $400. For the small sum, you now control $10,000 in stock, but at a much lower cost. That calculates into a savings of $9,600 on your capital outlay for the purchase. This savings can then be used to take advantage of other opportunities in the fixed income arena, thereby providing you with greater diversification and lowering your portfolio’s overall risk profile. The collection of the interest from the savings you’ve made by using options for your purchase creates what is known as a synthetic dividend. [/column]

What Is Hedging?

[column col=”1/2″]

Hedging is the calculated installation of protection and insurance into a portfolio in order to offset any unfavorable moves, and is designed to reduce or eliminate financial risk. We actively pursue this strategy by using a proprietary model to determine when markets have become near-term overextended, then enter transactions that we believe will protect against portfolio loss through a compensatory price movement.

[/column][column col=”1/2″]

Put simply, our hedging strategy warns us of impending market downturns, and prompts us to purchase put options that will rise as the current equity position falls.

[/column]

[space height=”1″]

Why Hedge?

[column col=”1/2″]

Most investors who buy and hold for the long term are counseled to ignore the short- and-mid-term fluctuations along the way. They completely ignore the necessity of hedging under the false sense of security that the stock markets will rise over time without fail.

While this may arguably be true over the long term – of about 20 to 30 years – short term declines of up to a couple of years can and do happen, and they can destroy [/column][column col=”1/2″]

portfolios that are not hedged. Not hedging in the markets today is akin to not buying accident insurance just because you’re a careful driver who always obeys the rules. There’s never a guarantee that unforeseen circumstances won’t happen. Consider this chart of the 2008 financial crisis:

[/column] [space height=”1″]  [space height=”1″] [column col=”1/2″]

[space height=”1″] [column col=”1/2″]

As an investor, how did your portfolio fare during the crisis? As you can see, hedging downside risk can make the difference between your getting to retire this year, or having to put it off until further down the road.

[/column][column col=”1/2″]

Strategic purchases of SPDR S&P500 (SPY) puts during the above periods would have mitigated much of the damage caused by market declines, thus protecting the portfolio and adding to overall portfolio performance.

[/column]

[space height=”1″] [space height=”1″]

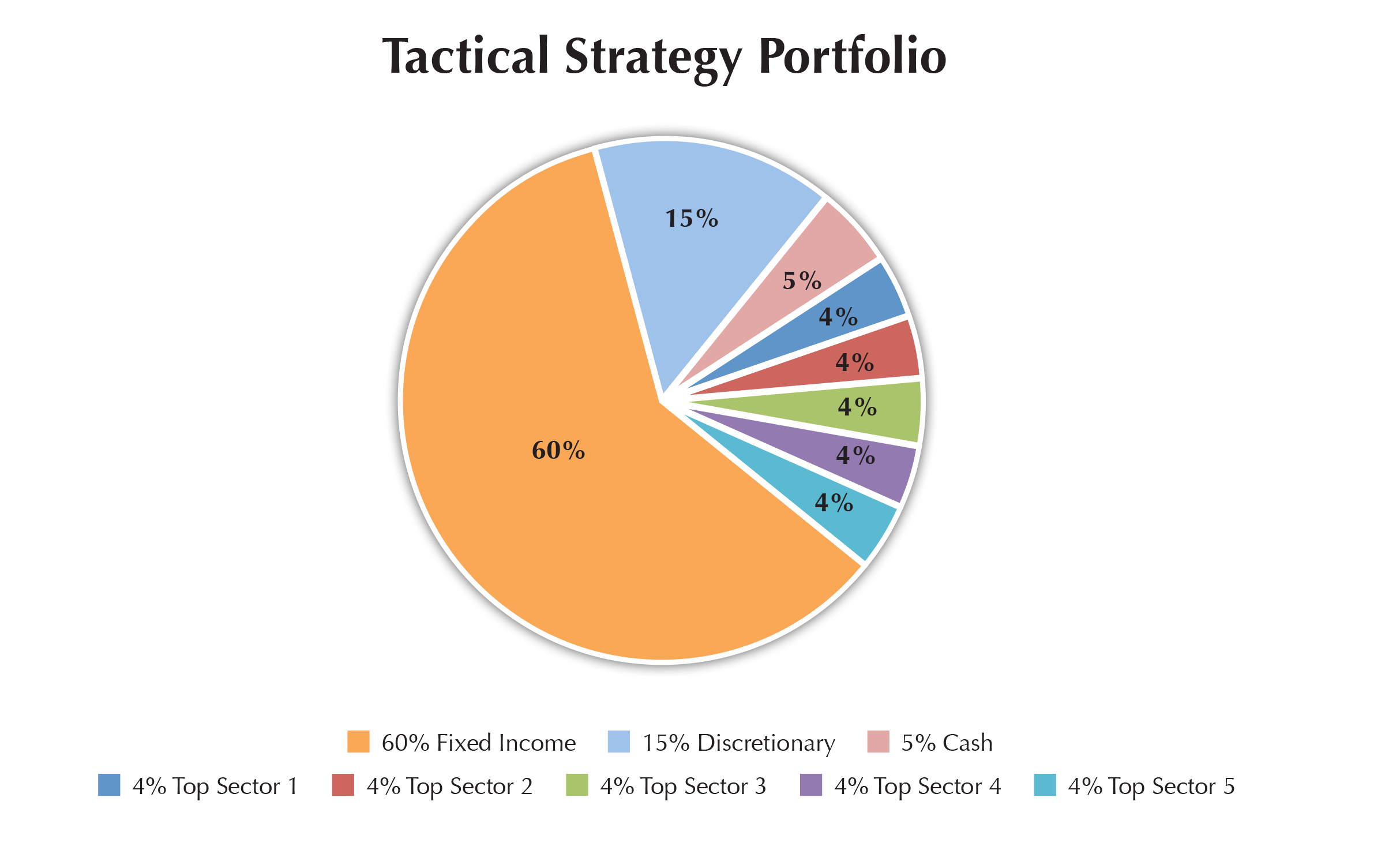

Tactical Strategy Portfolio

[space height=”1″] [column col=”1/2″]

[space height=”1″] [column col=”1/2″]

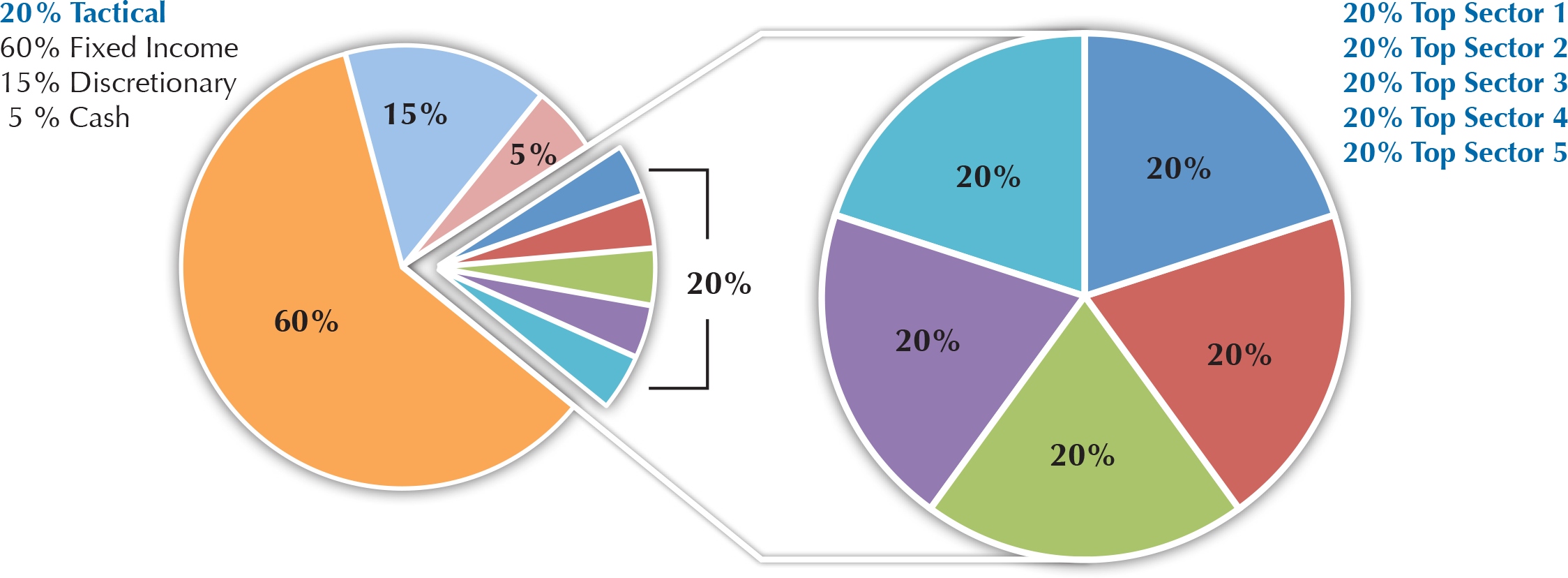

Tactical Sector Options Component – 15%

[list type=”bullet2″]

- Focused on investing in the top five fastest growing market sectors with periodical sector rotation to maintain to performance.

- Will leverage assets by utilizing options therefore exposing a small portion of the portfolio assets to market risk.

[/list]

Discretionary Component – 15% allocation

[list type=”bullet2″]

- This component is designed to provide funds for implementing hedging on the portfolio to further mitigate risk.

- It also provides funds to take advantage of short term profit opportunities in the market.

[/list]

[/column][column col=”1/2″]

Fixed Income Reserve – 60% allocation

[list type=”bullet2″]

- This component is to provide a safe conservative base of assets that does not correlate to the equities market therefore providing additional risk mitigation.

- A goal is to seek attractive yields in a variety of fixed income instruments with a short duration structure to eliminate the risk associated with rising interest rates.

- Seeks yields of 3% – 6% long term.

[/list]

Cash Component – 10% allocation

[list type=”bullet2″]

- This component is designed to provide liquidity for withdrawals or to weight other areas of the portfolio to further increase growth and/or reduce risk.

[/list]

[/column]